Project Overview

A leading Indian NBFC serving over 92 million customers. It offers home and commercial property loans, loans against property, business expansion funding, and finance for real estate developers, including lease rental discounting.

It had an existing customer portal for pre-purchased loans and aimed to enhance it for better user satisfaction. The redesign focused on making the platform more user-friendly, visually appealing, and responsive for both mobile and desktop users.

Industry: Finance

Product: Home Loan

Duration: 6 Months

Challenges

The biggest challenge was gaining a deep understanding of the housing finance market, the business model, and the needs of all stakeholders involved. The existing platform was not fully equipped to meet user requirements, and its poor user experience often left users frustrated, highlighting the need for significant improvements.

- Poor login steps

- Absence of important information on dashboard

- Update and modernise the cluttered design

- Non-responsive layout, affecting user experience across devices

Research

We began by analysing their existing platform, thoroughly examining the user flow, information architecture, navigation, and interaction patterns to identify areas for improvement. This process included evaluating the overall usability, pin-pointing gaps in functionality, and understanding how users interact with various features. Additionally, we assessed the platform's responsiveness and performance across devices to ensure a seamless user experience.

It Always Starts from the People

Our journey began with conversations with individuals who already have loans and actively use the customer portal. To dive deeper into their experiences, we conducted 7 semi-structured interviews and over 10 face-to-face interviews, including users from our platform and individuals using other loan platforms. These interactions, coupled with our research, revealed valuable insights into user challenges, expectations, and areas for improvement.

- Low Login Success Rate: Login process was not user friendly, user got confuse while login with different method.

- Limited Portal Usage: Users could not understand the dashboard's elements and their functionality.

- Unable to Find Essential Data: Crucial information was not easily find within the portal. The login process was not smooth and often presents obstacles.

Wireframes

Wireframes being an essential part of the design process, offering a low-fidelity blueprint of the user experience, added to the critical structure, content, and functionality of the interface. This allowed us to map out the user journey before refining the designs. Wireframes, which focused on layout and interactions, provided for quick iterations and important input, ensuring that we stay on track with user needs and project goals. This stage was critical in creating strong foundations for the final design.

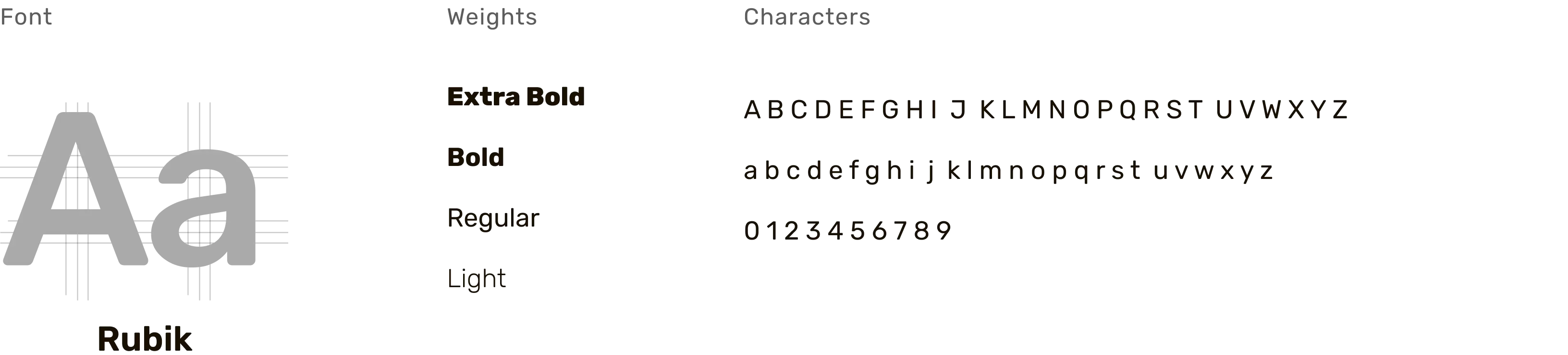

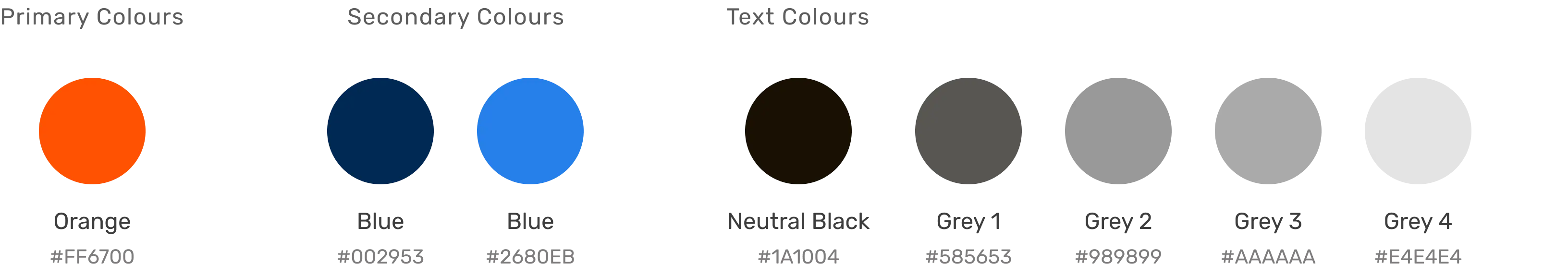

Style Guide

We maintained consistency by carefully selecting fonts and color palettes from the existing platform’s style guide. This approach ensured brand coherence, reinforced visual identity, and provided users with a seamless and familiar experience. Additionally, it enhanced usability, improved readability, and created a more intuitive interface.

Visual Design

Our visual design approach focuses on creating a seamless, intuitive, and engaging user experience while maintaining brand consistency. By carefully selecting fonts, colors, and UI elements from the existing platform’s style guide, we ensure a cohesive and familiar visual identity.

A clean and minimalistic layout enhances readability and usability, allowing users to navigate effortlessly. Thoughtfully placed visual hierarchy, contrast, and spacing improve information accessibility while maintaining aesthetic appeal. Interactive elements, such as buttons and progress indicators, are designed to be intuitive and responsive, enhancing user interaction.

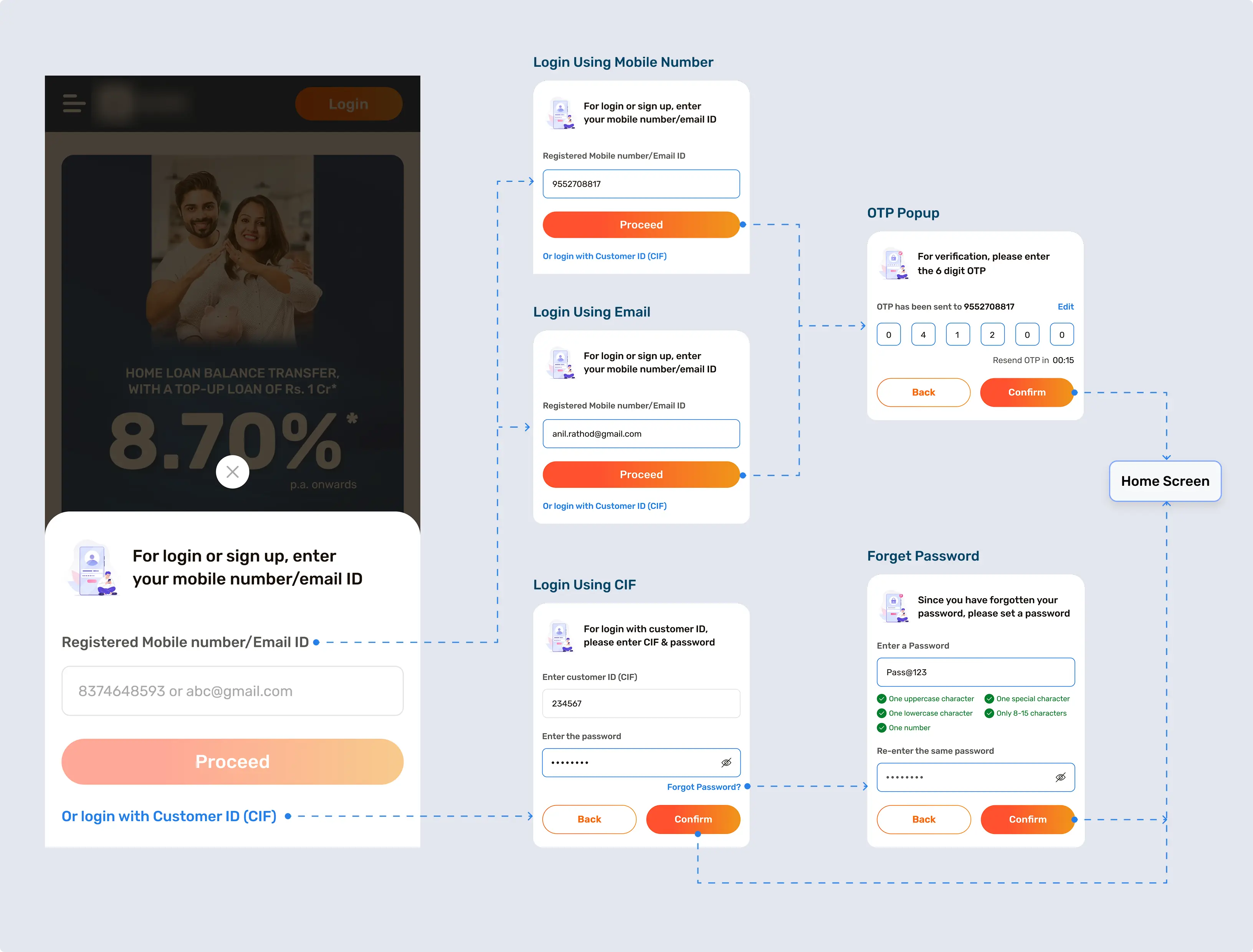

Login Journey

Users can log in using their mobile number, email, or CIF ID. The login page features a minimalistic and intuitive interface, ensuring a seamless login experience. By including only essential elements, the design prevents users from feeling overwhelmed. Additionally, a guided password recovery option assists users who forget their credentials, enhancing accessibility and user convenience. Security measures such as OTP verification and encrypted authentication further strengthen the login process.

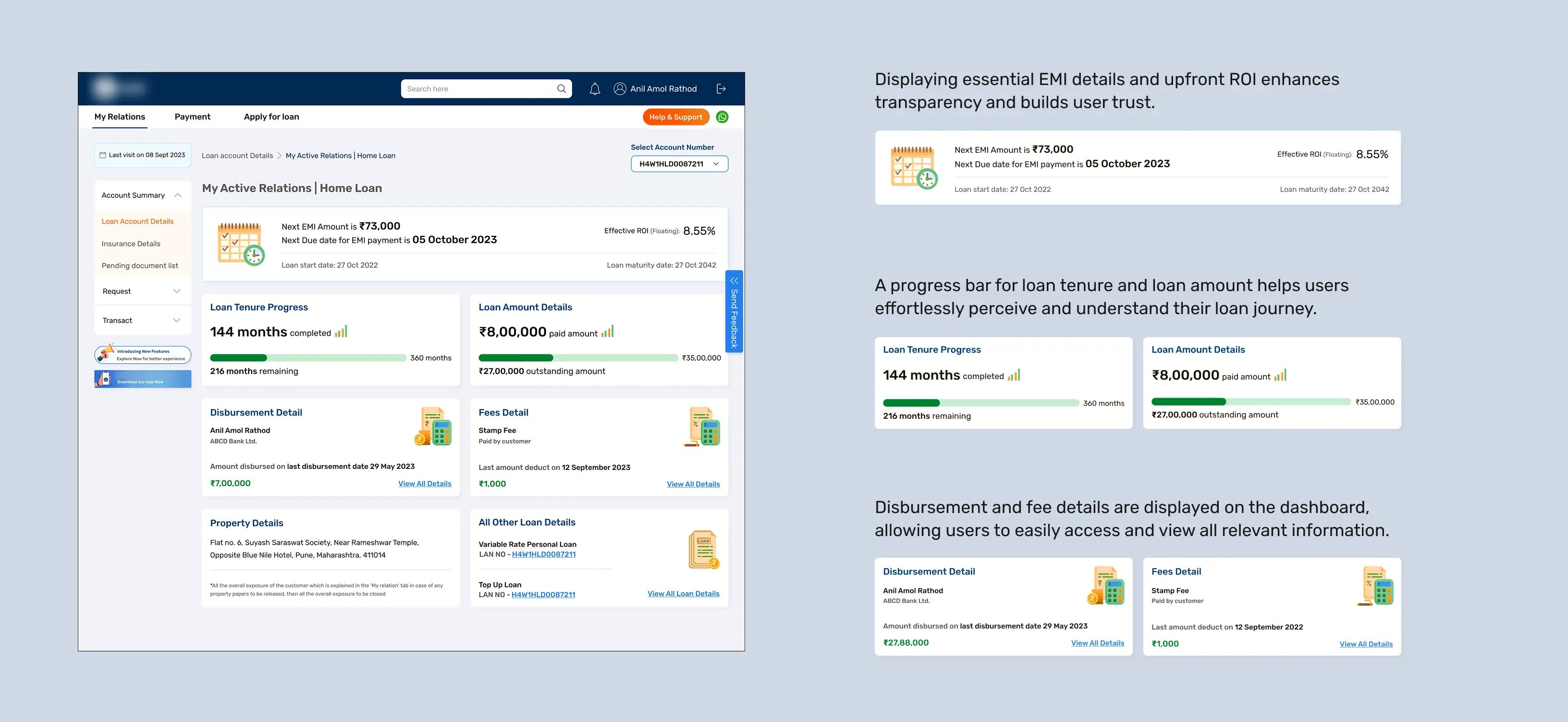

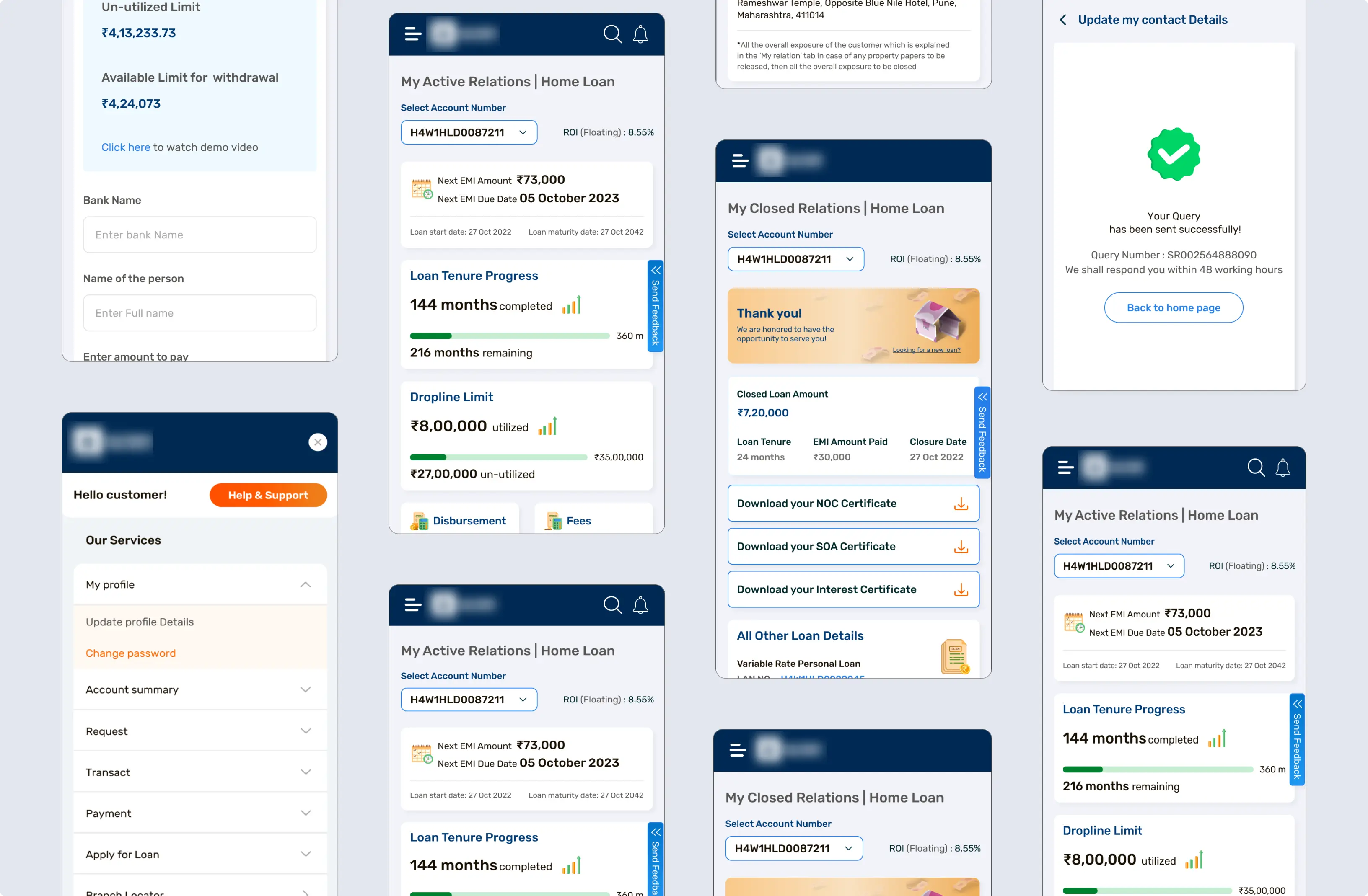

Dashboard Design

We redesigned the dashboard to provide a more intuitive and user-friendly experience. Key loan details, such as EMI breakdown, loan tenure, disbursement status, and fees, are now presented clearly for quick access. A streamlined layout, enhanced visual hierarchy, and interactive elements like progress bars help users effortlessly track their loan journey. By prioritizing clarity and ease of navigation, the new dashboard ensures a seamless experience, empowering users with real-time insights and actionable information.

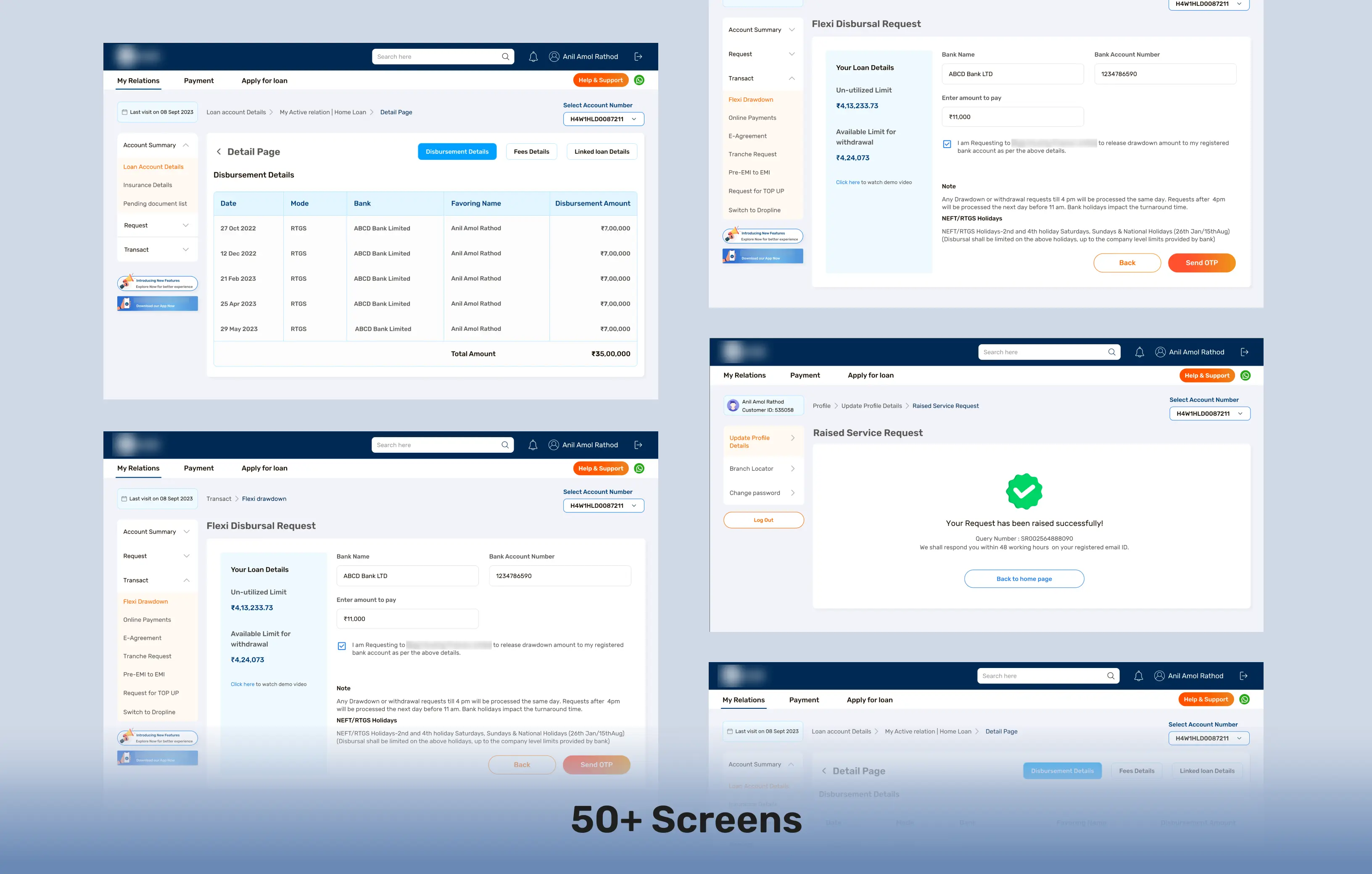

Other Screens

We redesigned all screens and user flows to align with the newly developed design components and style guide, ensuring a modern and cohesive experience. To maintain consistency across the product, we built a centralized component library, streamlining the design and development process. This approach not only enhanced visual uniformity but also improved scalability, efficiency, and collaboration.

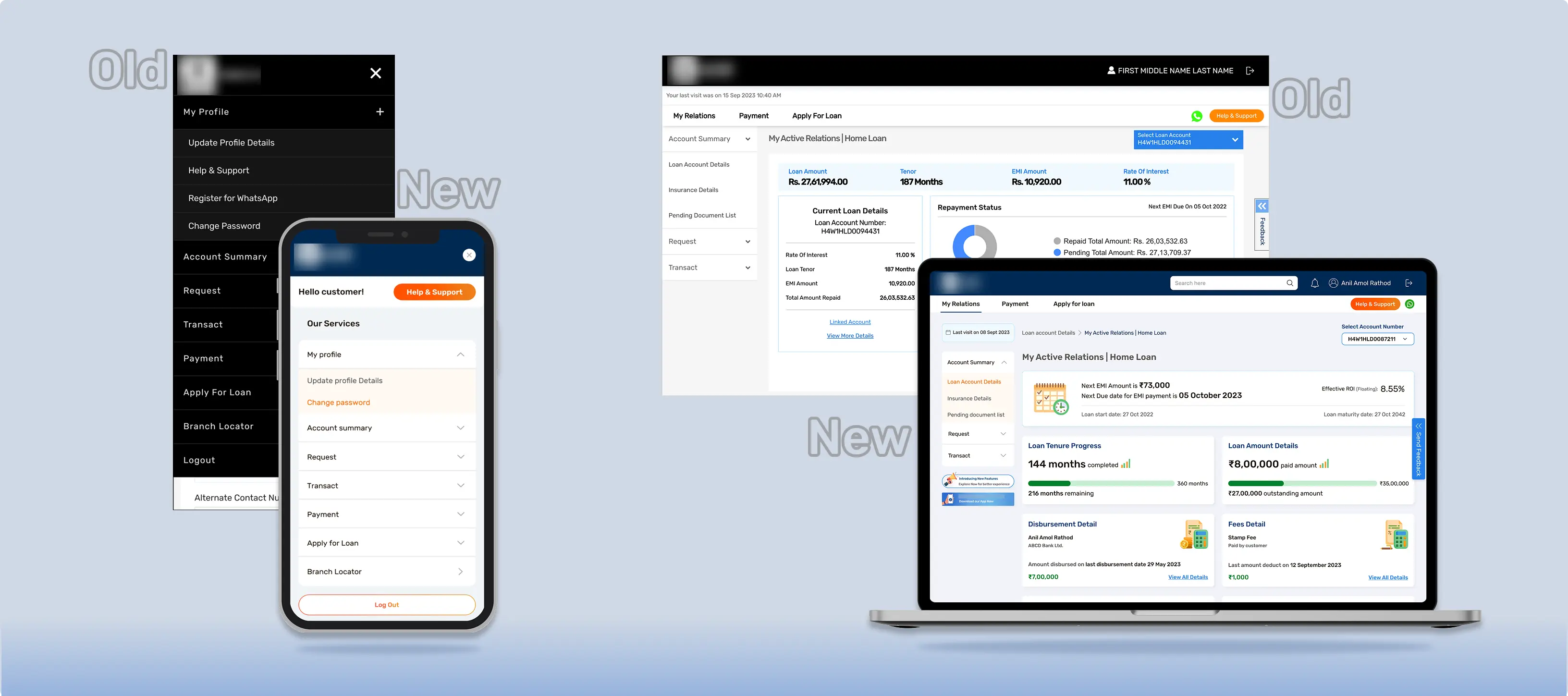

The old design laid a strong foundation and served us well over time. The new version, however, elevates the experience with a fresh perspective, refined functionality, and sleek aesthetics, creating a more intuitive and engaging user experience for the future.

Responsive Screens

Responsive design allows your platform to automatically adjust to any screen size, providing a seamless experience across desktops, tablets, and smartphones. It enhances usability and ensures your content is accessible to all users, regardless of their device.

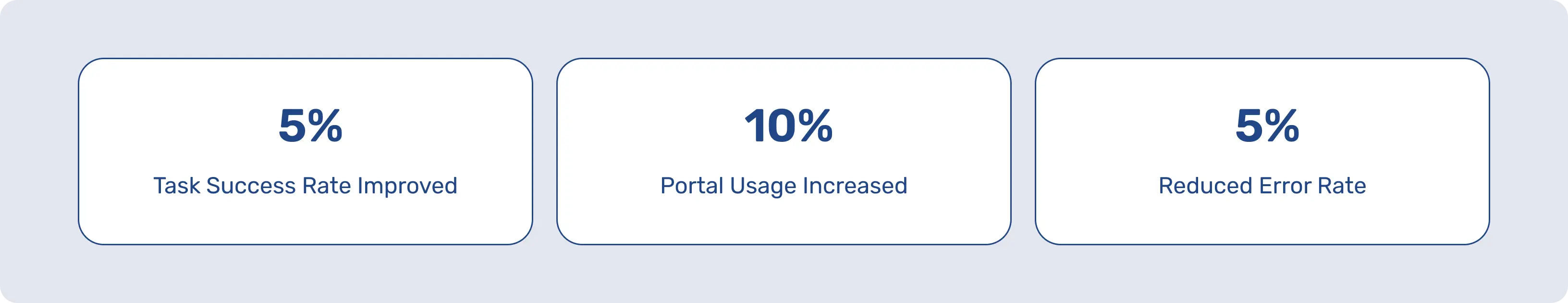

Business Impact

A strong business impact drives sustainable growth by streamlining operations, improving customer experiences, and enhancing brand presence. By adapting strategies to meet market needs, Bajaj Technology Services aimed to help the business build lasting value, foster loyalty, and stay ahead of the competition in an ever-changing environment.