In today’s digital-first landscape, speed is critical for insurance providers. A product configurator enables teams to independently design, customize, and roll out new products and customer experiences instantly, eliminating the need for technical support.

In a digital-first world, where insurance providers are expected to move fast, stay flexible, and deliver personalized solutions that meet evolving customer needs. Yet, traditional product development cycles often slow down innovation and responsiveness.

To address this challenge, we partnered with one of India’s largest NBFCs to co-create a breakthrough solution—the Product Configurator. With just four simple steps—selecting product details, defining premiums, configuring journey screens, and publishing instantly—insurance administrators can now go live with new offerings in minutes. The result? Faster time-to-market, reduced operational overhead, and a more agile response to customer demands. This dynamic, no-code platform empowers insurance teams to design, configure, and launch new products and customer journeys in real time, without relying on technical resources.

Unlocking Agility: Platform Capabilities That Drive Impact

At the heart of the Product Configurator lies a robust set of capabilities designed to support the creation and management of sachet insurance products - those with low ticket sizes and high relevance for everyday risks. The platform empowers business teams to build, customize, and validate product journeys with precision and speed.

Here’s what makes it powerful:

- Product Construct- Define the core structure of a product, including its type, category, name, and manufacturer-laying the foundation for a tailored insurance offering.

- Journey Customization- Configure customer-facing sections and screens that align with the product construct, ensuring a seamless and intuitive user experience

- Product Specifications- Set rules for premium calculation, tenure, pricing grids, and coupon code functionality-giving teams full control over commercial logic.

- Smart Validations- Apply business rules such as age limits, price capping, and date-of-birth restrictions to ensure compliance and accuracy across journeys.

These capabilities enable insurers to launch hyper-personalized products at scale, while maintaining operational control and regulatory alignment.

Solving Real-World Challenges in Insurance

The Product Configurator was purpose-built to address some of the most persistent challenges in traditional insurance models—especially when it comes to micro and sachet products. Here are the key business problems it helps solve:

- Underserved Everyday Risks- Conventional insurance often overlooks smaller, high-frequency risks-like losing a wallet, mobile damage, or trip delays-that matter to customers. The platform enables rapid creation of sachet products that fill these critical protection gaps. An example- A commuter loses their wallet during a metro ride. Traditional policies don’t cover such incidents, but with the configurator, a Wallet Care sachet product was launched—offering quick, affordable protection for such everyday mishaps.

- Cumbersome Application Processes- Lengthy forms, manual approvals, and complex workflows discourage customers from opting into low-ticket insurance. With real-time journey configuration and instant issuance, the platform simplifies onboarding and enhances customer experience. An example for this is- A customer looking to buy Trek Cover for a weekend trip can now complete the entire journey-from product selection to payment and policy issuance-in under 2 minutes, thanks to the configurator’s real-time journey builder and instant issuance capabilities.

- Limited Business Flexibility in Product Creation- Fragmented systems and dependencies across teams slow down innovation and inflate costs. The Product Configurator brings everything into one unified interface-reducing time-to-market, improving collaboration, and driving operational efficiency. For example- Previously, launching a new product like Eyewear Assure required coordination across tech, ops, and compliance teams, taking weeks. With the configurator, the business team independently built and launched the product in just a few hours-reducing time-to-market and enabling faster experimentation.

Our Solution: Sachet Insurance & Subscription-Led Innovation

To overcome the limitations of traditional insurance models, we introduced a suite of affordable, modular sachet insurance products-powered by the flexibility and speed of the Product Configurator. These offerings are designed to meet everyday protection needs while delivering a frictionless experience for both customers and agents.

Here’s how the solution comes to life:

- Universal Product Framework- A reusable architecture that supports both web and mobile views, enabling consistent and scalable product journeys across channels.

- Streamlined Application & Payment- Minimal user input combined with multiple payment options-cards, UPI, wallets-makes onboarding quick and hassle-free.

- Diverse Product Portfolio- From Wallet Care and Trek Cover to Helmet Insurance and Eyewear Assure, our products are tailored to real-world scenarios that customers face every day.

- Instant Policy Issuance- Seamless integration with partner APIs ensures real-time policy generation, enhancing customer satisfaction and operational efficiency.

- Multi-Partner Logic Handling- Separate Business Rule Engines (BREs) manage premiums across partners, with smart logic to list plans from lowest to highest premium-making comparison easy and transparent.

- Quote Regeneration & Comparison Tools- Agents can regenerate quotes and compare exclusions, claims, and features across partners-empowering informed decision-making.

- Smart Nudging & Engagement- Integrated with platforms like CleverTap and Adobe, the solution enables real-time customer engagement through personalized nudges and reminders.

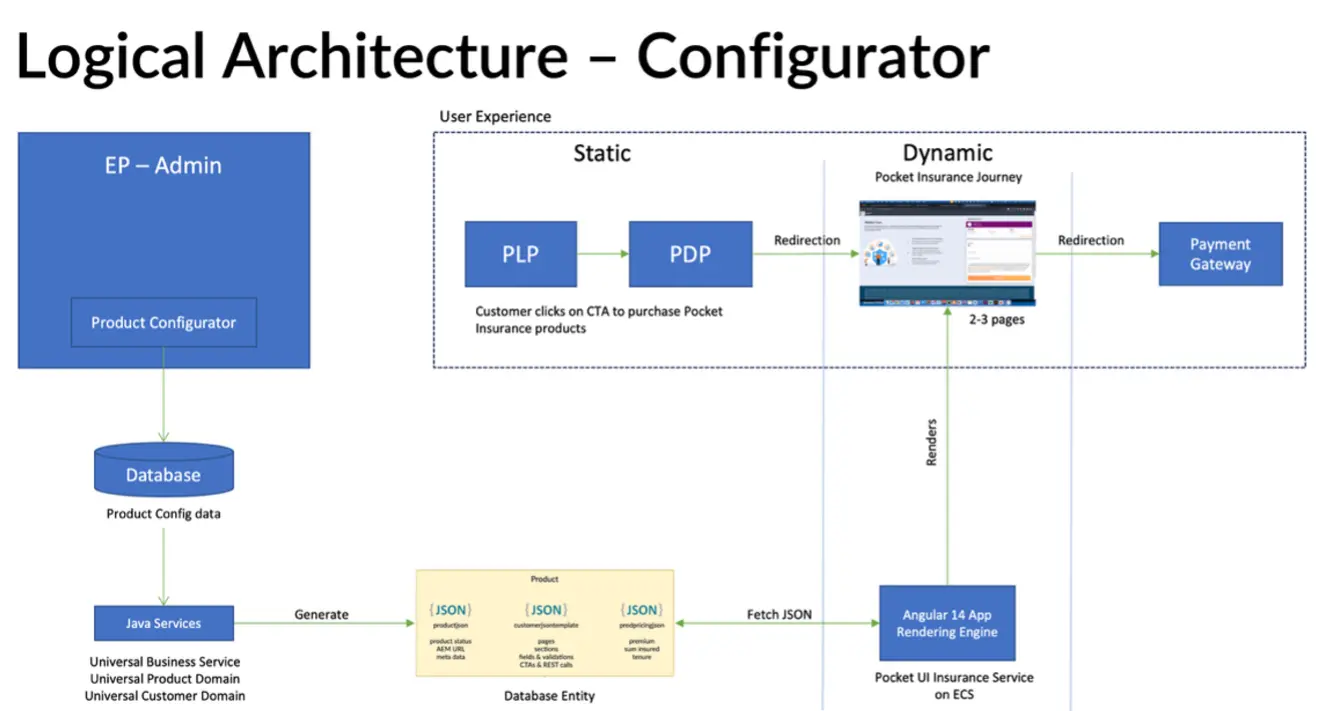

Behind the Scenes: The Architecture Powering Product Configurator

Delivering real-time insurance journeys at scale requires more than just a great interface-it demands a strong, scalable foundation. The Product Configurator is built on a modular, cloud-native architecture that ensures seamless product creation, smooth customer experiences, and robust backend integration.

Here’s a breakdown of the key architectural components:

- Admin Layer (EP Layer)- This is the control center where insurance administrators configure products. All configurations are stored in a dedicated database, ensuring traceability and version control.

- User Experience Layer-

- Static Components: Includes the Product Listing Page (PLP) and Product Detail Page (PDP), where customers explore offerings and initiate purchases.

- Dynamic Components: Manages the end-to-end configurator , including redirection across 2–3 screens and integration with payment gateways for a seamless checkout experience.

- Java Services Layer- A set of modular services-Universal Business Service, Universal Product Domain, and Universal Customer Domain-that enable scalable and reusable interactions across journeys and partners.

- Data Management Layer- Uses JSON-based services to manage structured entries across Product, Customer, and Business domains, ensuring consistency and flexibility in data handling.

- Rendering Engine- Built on stable version of Angular and deployed on Amazon ECS, this engine powers the Product Configurator Insurance UI, delivering fast, responsive, and mobile-optimized experiences.

Together, these components enable real-time data flow between the frontend and backend, supporting both static and dynamic journeys with high reliability, performance, and scalability.

Impact Delivered: Real Numbers, Real Results

The Product Configurator has not only transformed how insurance products are built and launched-it has delivered measurable business impact across customer experience, operational efficiency, and revenue generation.

- Customer Engagement & Experience-

- Daily applications reflect strong customer interest and ease of access to sachet insurance products.

- Customers now enjoy coverage for everyday risks like wallet loss, eyewear damage, and travel delays-enhancing peace of mind and financial resilience.

- Operational Efficiency-

- A great number of total sachet product business is now built through DIY journeys-empowering business teams and reducing dependency on tech.

- 99.60% platform uptime ensures uninterrupted service and a reliable experience for both customers and partners.

- Real-time policy issuance and quote comparison tools have streamlined agent workflows and improved decision-making.

Conclusion: A Strategic Shift in Insurance Innovation

The Product Configurator has redefined how insurance journeys are conceptualized, built, and delivered. For our client-one of India’s largest NBFCs-it has evolved from a functional tool into a strategic enabler of innovation, agility, and growth.

We’ve achieved meaningful scale and operational excellence-with a large volume of policies issued, strong premium collections and consistently high system reliability. These milestones reflect the trust our customers place in us and the strength of our platform. the platform has proven its ability to scale, perform, and deliver real customer value. More importantly, it has empowered business teams to take control of product creation, reduced time-to-market, and opened new avenues for customer engagement through sachet and subscription-based insurance.

As the insurance landscape continues to evolve, the Product Configurator stands ready to support future innovations-making insurance more accessible, personalized, and impactful than ever before.